USD Keeps Focus on the Presidential Debates, Pound still Under Pressure

The centerpiece of the calendar of events today is the first televised debate of US presidential candidates. The event is expected to move the markets as participants may outline foreign trade, fiscal and investment policies that they would pursue in case they get elected. This includes the fate of the tariff war initiated by Trump, collapsed bilateral and multilateral agreements (NAFTA, TPP, etc.), and, of course, government debt and spending path. However, among the various scenarios of power control in the United States, significant shifts in government policies are expected to occur only in outcomes where one of the parties gain control both over House and Senate. Taking as example the current situation, where Democrats control the lower house, and Republicans control the Senate, and Republican Trump is in the presidency, we can see that major legislative decisions still require bipartisan support. The president's ability to act independently is largely limited to executive orders.

Democrat Joe Biden goes to debate today with a 5 percent lead in the polls (some polls give a 10-point lead). Biden's economic course should lead to a faster economic recovery and achievement of full employment, but the price for this will be a faster growth of the public debt. Trump's spending program is more frugal (which implies a slower pace of government borrowing), and his victory would mean a continuation of the tariff war in one form or another. Consequently, Trump's re-election should be positive for the USD, however, if Biden comes to power, low rates for a long time and the shift in emphasis from protectionism to free trade are expected to negatively affect USD.

How the debate will affect the chances of a Biden or Trump victory will also determine how the pressure on the dollar changes - whether it falls or rises.

The data on consumer inflation in Germany, the release of which is scheduled for today, may add to the argument that the ECB will further soften the policy. This conclusion can be drawn from yesterday's speech by ECB President Christine Lagarde, in which she said that the Central Bank is ready to increase credit stimulus if necessary, to support economic recovery (this includes curbing deflation). Lagarde also reiterated that the euro exchange rate will influence the medium-term inflation forecast (in effect, recognizing that the euro exchange rate influences CB policy).

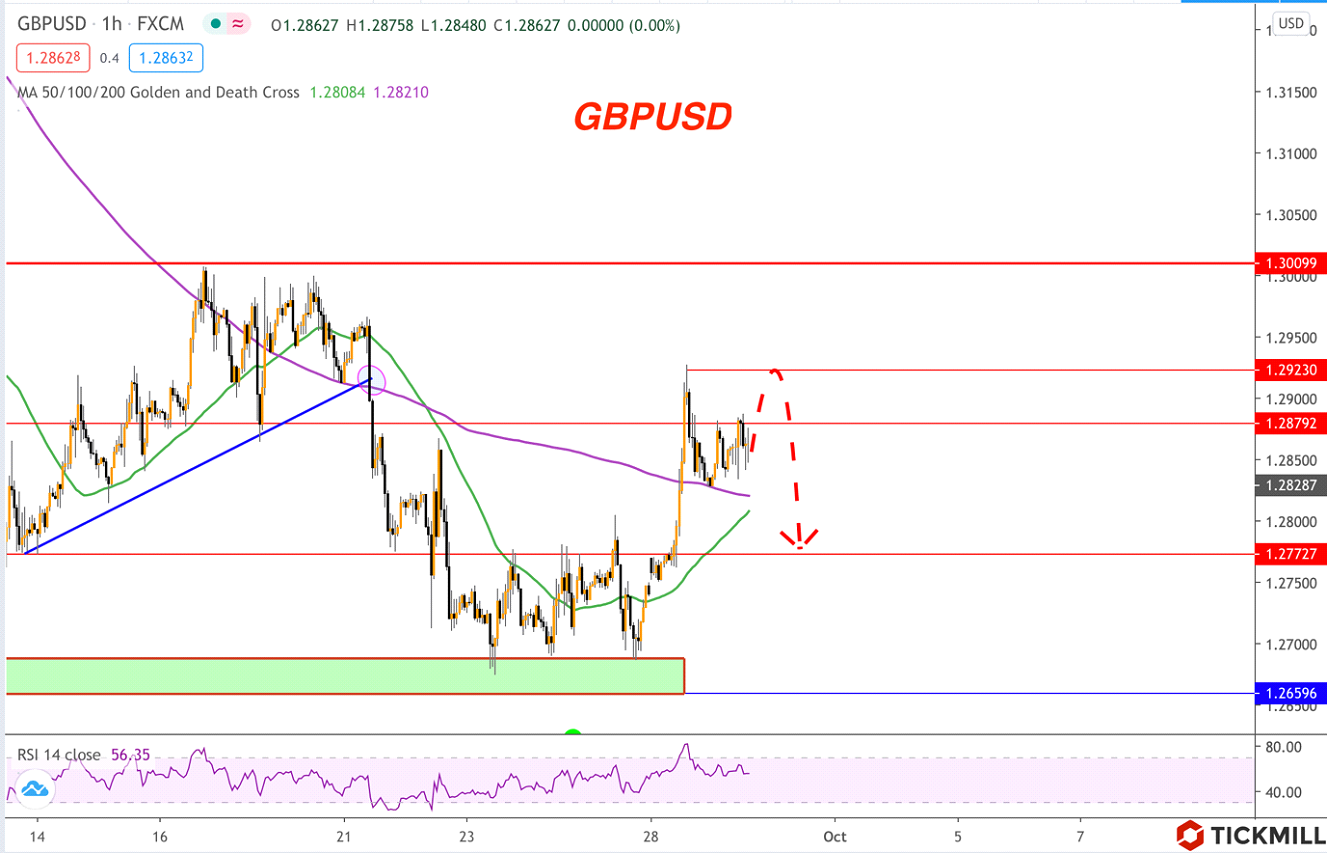

Sterling continues to be hostage to EU-UK talks on bilateral trade and other agreements, despite the latest episode of recovery. The pair's downside risks remain high due to the likelihood of litigation if the UK tries to dodge the EU exit agreement. The short-term dynamics of the pound may well hide breakout movements if the deadlock in the negotiations becomes more evident. The balance of risks for the pound, in my opinion, is shifted downward and selling on GBPEUR and GBPUSD still remains relevant:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.