A Rough Patch for Wall Street’s ‘Big Five’?

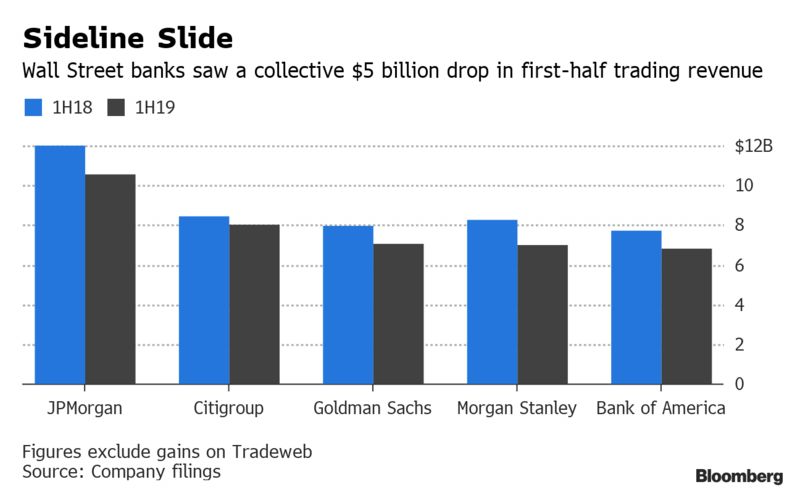

Morgan Stanley’s financial results were released on Sunday, completing the reporting of the five largest US banks for Q2, 2019. The data showed that the trading business of the banks have now officially entered into a ‘bad streak’ as the disastrous results for Q1 stretched into Q2, despite the bull market for 80% of the first half of the year:

According to Bloomberg estimates, the first half of the year was the most unprofitable for banks in almost 10 years. The banks themselves “rationalized” their weak results, citing increased unpredictability of market response to trade war headlines, as well as an erratic and uncertain stance of the world central banks. However, trading activity based on the same factors of uncertainty was much higher in 2018, indicating ongoing decline in risk-taking, along with increasing awareness about the looming ‘end of the expansion’ cycle. The Chief Financial Officer of Morgan Stanley said in an interview last Thursday that, recently the market has lost many traditional features, such as the active reshuffling of the market portfolio, the use of leverage, etc.

European banks are expected to upset investors even more in their trading revenues next week.

One of the reasons for decline is the hedge funds slowly bleeding with capital, which is what naturally subdues trading activity. In addition, the new rules that restrict the ability of investors to bet themselves, turned out to be another “headwind”. Dovish Central Bank comments and subsequent decline in volatility reduced the demand for hedging by speculators, thus diminishing the bank’s trading business.

One can only imagine what reporting will show during a bear market if profits decline when the SPX reaches a historical record.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.