FTSE FINISH LINE

The FTSE 100 saw a marginal increase on Tuesday as industrial miners rose, prompted by a surge in Anglo American following a merger agreement. Industrial miners experienced a 3.2% rise, with Anglo American leading the charge as its shares soared by 9.9%, making it the standout performer on the FTSE 100. The surge followed the announcement of a $53 billion merger agreement with Canada's Teck Resources, resulting in the creation of a new entity named Anglo Teck. While uncertainties remain about the potential value the Teck acquisition might deliver to the company and its shareholders, the merger marks a significant boost for the UK stock market. The newly formed Anglo Teck will hold its primary listing in London, reinforcing the city's status as a key financial hub. Anglo firmly believes that the UK serves as an effective listing venue, which sends a strong, positive signal to other companies navigating mergers and acquisitions. Precious metal miners extended their rally for the third consecutive day, driven by rising gold prices. Endeavour Mining gained 2.1%, while Hochschild Mining advanced 1.3%.

Shares of Dunelm Group, a British homeware retailer, fell by 5.2% to 1176p. The company has stated that it has not yet witnessed any signs of a sustained recovery in consumer demand in the market. However, it expressed satisfaction with its trading performance in the early part of its fiscal year 2026. The company reported a pre-tax profit of 211 million pounds ($286.41 million) for the fiscal year, marking a 2.7% increase from the previous year. Overall, the stock has appreciated by approximately 20% year-to-date, compared to a 5.15% rise in the FTSE Mid 250 Index.

Mobico's shares plummeted by as much as 21.9% to 25p, marking their lowest point since June 18. The adjusted operating profit, excluding the North America school bus segment, fell over 12% to £59.9 million ($81.28 million) in the first half of FY25. The company has announced cost-cutting measures across the group and reaffirmed its FY25 adjusted operating profit guidance of £180 million to £195 million. With the losses from this session, the stock has now decreased by approximately 69% year-to-date.

Luceco, a manufacturer of electrical components, saw its shares increase by 7.3% to 127p, marking it as one of the top performers on the FTSE small caps index. The company reported a half-year adjusted operating profit of £13.8 million, up from £12.6 million the previous year. It remains on track to meet full-year expectations with minimal direct exposure to US/China tariffs. Analysts at Peel Hunt anticipate significant profitability growth as the electric vehicle market expands and the company continues to pursue strategic mergers and acquisitions. Up to the last closing, the stock has gained 12.2% this year.

Computacenter increases by as much as 9.6% to 2,550p, making it the second-largest percentage gainer on the FTSE midcaps index. The British technology and services company reports a strong start to Q3, particularly in North America. It posted H1 revenue of 3.99 billion pounds ($5.41 billion), compared to 3.1 billion pounds a year earlier. The company continues to anticipate FY25 adjusted operating profit will exceed last year's figures. Jefferies suggests FY24 will be impacted by several one-time events that are not likely to happen again in FY25. Year-to-date, CCC has risen 18.5%, while FTMC has increased by 5.4%.

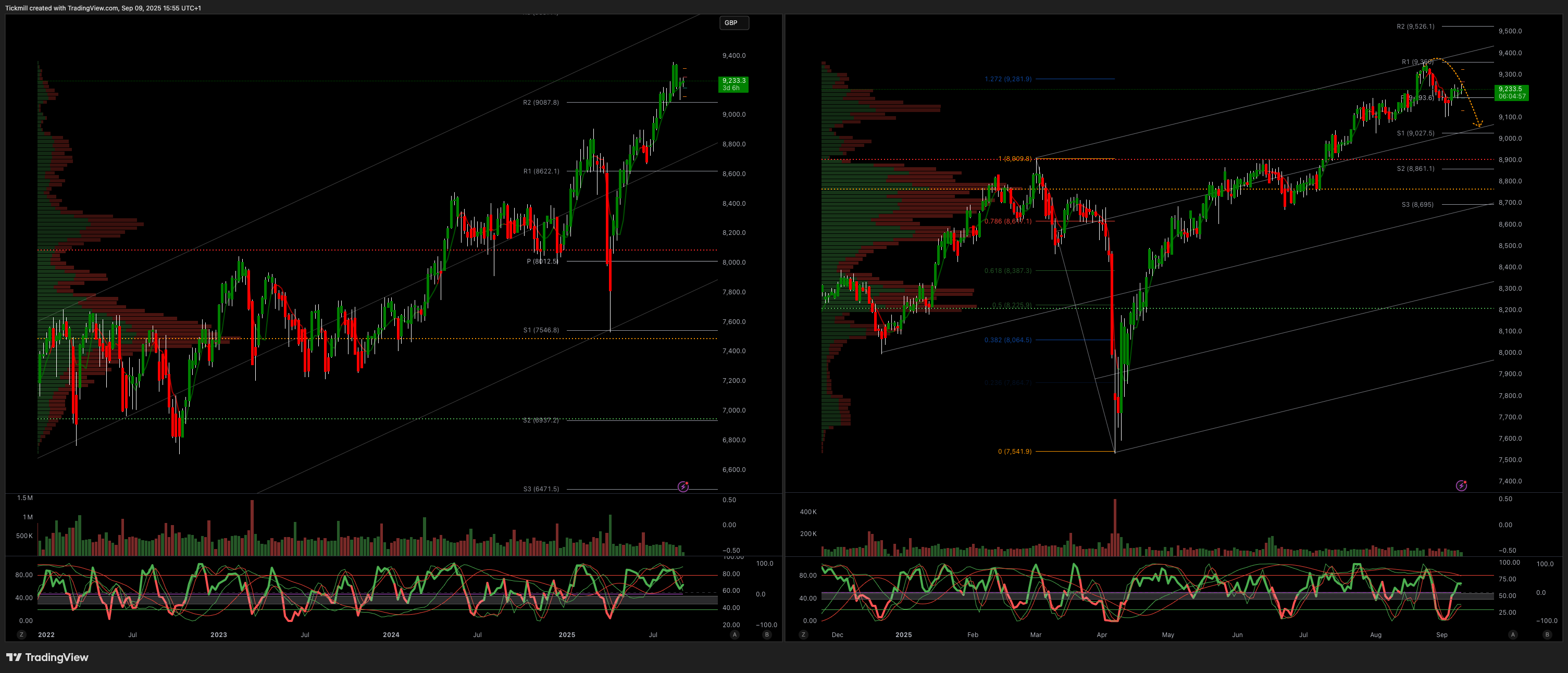

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!