EURGBP Hits Highest Levels in 10 Years on Brexit Fears

GBP Down Despite Data Beats

It’s been an interesting week for the GBP as we’ve had a raft of data out, the majority of which surprised to the upside! However, price action has remained stubbornly muted. So, on Tuesday we had labour market data out of the UK, which saw average weekly earnings ticking up to post cycle highs of 3.9%, against an expected 3.8%. This was tempered though, by the unemployment rate moving back up to 3.9% from the prior 3.8%. This data was followed on Wednesday by a set of solid inflation numbers with headline UK CPI for July printing 2.1% vs 1.9% expected and core CPI printing 1.9% vs 1.8% expected. Finally, on Thursday we saw retail sales printing strongly over July also at 2.9% vs 2.3% prior. However, despite the mostly positive data over the week, the ongoing cloud of Brexit on the horizon has meant that any upside in GBP has been heavily capped.

Over the last week or so, the prospect of a no deal Brexit has increased materially, with pessimism regarding the outlook for the UK in the event of such an outcome, outweighing positive data in the short term.

Time's Running Out

UK politicians return from summer in two weeks time and from that point there will be less than two months until the October 31st Brexit deadline. Given the limited time frame, the market is growing increasingly worried that parliament will be unable to block a no deal Brexit From happening. This has been reflected clearly in price action with GBP down around 3% against EUR since Johnson became PM.

Johnson Holds Firms

With Johnson remaining steadfast in his demands that the Irish backstop issue must be scrapped in order for a deal to be done, it seems that the ball is in the EU’s court. However, the EU too has been equally stubborn over its insistence that the backstop is retained. At this stage, it seems that unless the EU feels that the economic fallout from a no deal Brexit will be severe enough to warrant a deal which excludes the backstop, then a no deal Brexit will happen.

Angela Merkel Calls For Brexit Deal

German chancellor Angela Merkel this week pleaded with EU leaders to negotiate with the UK and deliver a deal saying that the UK and the EU need to maintain a “close partnership” following the UK’s exit. Merkel told reporters following her meeting with the Lithuanian president, “We have, of course, spoken about Britain’s exit from the European Union and this regard made clear that we want a withdrawal that will at the same time yield a close partnership between Britain and EU member states.”

Merkel’s comments come just after the latest data shows that Germany is on the brink of a recession for the first time in a decade, and no doubt reflecting her administration’s fears over how bad the damage to the German economy will be in the event of a no deal Brexit. As the clock continues to tick, neither side are as yet showing any signs of backing down.

Technical Perspective

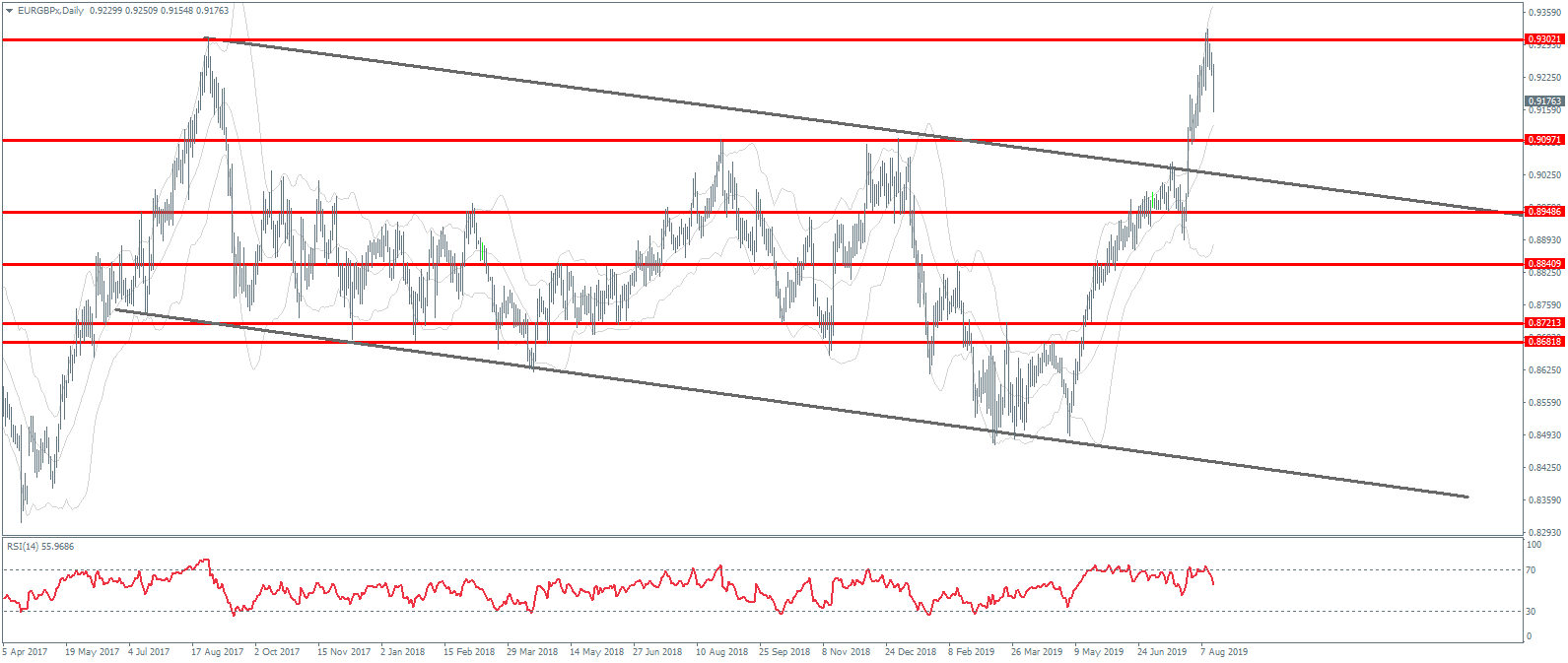

EURGBP tested, and briefly broke above, the 2017 highs this week to trade its highest levels since 2009 before sellers stepped in to take price lower. However, while price remains above the recently broken .9097 level, focus remains on a continued grind to the upside. If we break down from here, the next support below there is the .8948 level with a retest of the broken bearish channel top in the vicinity also.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.